Highlights of the Information

Technology Industry in Uruguay

Aspectos Destacados de la Industria de Tecnologías de la Información en

Uruguay

Rafael Sotelo [1],

Mariana Rizzi [2]

Recibido: Junio 2020 Aceptado:

Octubre 2021

Summary.- Uruguay has outstanding

achievements in Information Technology (IT) Industry. For example, it is the

country in Latin America with the highest USD export rate of IT per capita and

integrates Digital 9, the international forum of the nine governments who lead

in pioneering digital practices to improve citizens' lives. This short article

analyzes aspects of the history, infrastructure data and key indicators of the

IT industry in Uruguay. It also addresses the challenges that the IT ecosystem

faces for the future.

Keywords: IT Ecosystem; IT

indicators; IT in Latin America; e-government; industry status; industry

challenges.

Resumen.- Uruguay tiene logros sobresalientes en la Industria de

Tecnología de la Información (TI). Por ejemplo, es el país de América Latina

con la mayor tasa de exportación de TI per cápita en USD e integra Digital 9,

el foro internacional de los nueve gobiernos que lideran en prácticas digitales

pioneras para mejorar la vida de los ciudadanos. Este breve artículo analiza

aspectos de la historia, datos de infraestructura e indicadores clave de la

industria de TI en Uruguay. También aborda los desafíos que enfrenta el

ecosistema de TI para el futuro.

Palabras clave: Ecosistema de TI; Indicadores de TI;

TI en América Latina; gobierno electrónico; estado de la industria; desafíos de

la industria.

1. Introduction. - Uruguay has traditionally been recognized as an exporter of goods mainly

associated with agricultural and commodity production. However, in recent years

the growth of the IT industry has been internationally highlighted. In 2017 and

2018 exports of informatics and telecommunications exceeded those of milk and

rice. To accompany such development, several investments have been made in the

sector and there are currently multiple offers to train in IT. Nevertheless,

the sector still has a lot of potential to develop. To address this matter,

business chambers together with government agencies have been working for

several years to reinforce human resources in the sector and publicize the benefits

and potential of the industry.

The objective of this short

article is to analyze aspects of the history, infrastructure data and key

indicators of the IT industry in Uruguay. The next section describes the status

of Uruguay in the regional context. Section II describes aspects of the

county´s infrastructure. Section III presents the IT industry in numbers.

Section IV outlines the impact in education and academia and section V

concludes.

2. Status in regional context. - Uruguay

population is 3.3 million people. It stands out for having a democracy and

stable policies, as well as having an investment grade. These characteristics

make it a reliable destination for companies that wish to conduct business in

the country. Traditionally it has been an exporter of commodities produced from

agriculture like beef, wool, derivatives

of milk, soy and rice.

Nowadays, the country is internationally recognized regarding

information technologies. The early introduction of Computer Science education

decades ago, the quality of its human resources, the regulatory framework that

favors the export of software services and the support of government agencies

have been key factors for the development of the industry.

Uruguay is member of D9 (Digital 9) since 2018. D9 is a collaborative

network of the world's leading digital governments that pursue the use of digital technology to improve citizens’ lives. During

2019 Uruguay chairs the group, which is also composed of Estonia, Israel, New

Zealand, the Republic of Korea, the United Kingdom, Canada, Mexico and Portugal

[1].

Recently, Uruguay has been highlighted as the leading per capita

exporter of software in Latin America, reaching USD 120 per capita[3]. By way of comparison, Uruguay neighbors Brazil[4] and Argentina[5] export USD 12 and USD 47 per person respectively.

In Latin America region, it also stands out as one of the countries with

the highest average downloading and uploading speed, occupying the first

position in mobile broadband download speed and exceeding the global average

[6]. Table I and Table II show the figures of download and upload speed in

Latin American countries in August 2018 based on information from Speedtest Global Index.

|

Fixed broadband, August 2018 |

|

|

|

|

Global Average Download: 66,52 Mbps |

|

||

|

Global Average Upload: 35,09 Mbps |

|

||

|

Country: |

Mbps Download |

Mbps Upload |

|

|

Chile |

85,05 |

19,17 |

|

|

Panama |

76,09 |

13,50 |

|

|

Paraguay |

58,83 |

9,51 |

|

|

Uruguay |

45,62 |

11,43 |

|

|

Brazil |

42,47 |

21,23 |

|

|

Dominican Republic |

34,58 |

9,28 |

|

|

Mexico |

31,86 |

12,43 |

|

|

Argentina |

31,15 |

6,95 |

|

|

Peru |

28,65 |

5,28 |

|

|

Costa Rica |

23,91 |

6,08 |

|

|

Colombia |

23,28 |

12,58 |

|

|

Ecuador |

18,62 |

16,33 |

|

|

Bolivia |

12,48 |

5,82 |

|

|

El Salvador |

11,89 |

4,87 |

|

|

Guatemala |

11,75 |

5,80 |

|

|

Nicaragua |

8,02 |

7,89 |

|

|

Venezuela |

3,53 |

1,35 |

|

|

Source: Own elaboration based on data from Speedtest

Global Index, https://www.speedtest.net/global-index |

|||

Table I. Fixed broadband download and upload of speeds in Latin American

countries. Source own elaboration based

on data from Speedtest Global Index.

|

Mobile,

August 2018 |

|

|

|

|

Global Average Download: 28,02 Mbps |

|

||

|

Global Average Upload: 10,87 Mbps |

|

||

|

Country: |

Mbps Download |

Mbps Upload |

|

|

Uruguay |

29,02 |

13,71 |

|

|

Mexico |

25,79 |

12,42 |

|

|

Peru |

23,47 |

14,00 |

|

|

Dominican Republic |

23,07 |

9,80 |

|

|

Brazil |

23,02 |

9,66 |

|

|

Nicaragua |

22,75 |

11,94 |

|

|

Argentina |

21,89 |

10,16 |

|

|

Ecuador |

20,33 |

11,00 |

|

|

Chile |

20,08 |

13,11 |

|

|

Costa Rica |

18,83 |

8,21 |

|

|

Colombia |

18,05 |

11,09 |

|

|

Guatemala |

16,67 |

13,01 |

|

|

Bolivia |

16,12 |

11,30 |

|

|

Paraguay |

14,74 |

9,59 |

|

|

Panama |

12,30 |

10,36 |

|

|

El Salvador |

10,30 |

5,70 |

|

|

Venezuela |

7,07 |

4,34 |

|

|

Source: Own elaboration based on data from Speedtest

Global Index, https://www.speedtest.net/global-index |

|||

Table II. Mobile download and upload of speeds in Latin American

countries. Source own elaboration based

on data from Speedtest Global Index,

https://www.speedtest.net/global-index

Some figures of the latest report from the ITU [7] are represented in

Table III. The country has the highest percentage of homes with computers in

the region. It also has a percentage of the population connected to 3G and to

LTE above the average of the Americas and the World.

|

|

2017 |

||

|

|

Uruguay |

The Americas

|

World |

|

3G Coverage (% of population) |

95,0 |

93,9 |

87,9 |

|

LTE/WiMAX coverage

(% of population) |

88,0 |

84,3 |

76,3 |

|

Individuals using

the Internet (%) |

68,3 |

67,5 |

48,6 |

|

Households with

a computer (%) |

70,9 |

64,8 |

47,1 |

|

Households with

internet access (%) |

64,0 |

68,3 |

54,7 |

|

Source: Measuring the Information Society Report 2018, volume 1 &

2 - International Telecommunication Union |

|||

|

|

|||

Table III. Telecommunication coverage comparison of Uruguay, the

Americas and the World. Source

Measuring the Information Society Report 2018, volume 1 & 2 – International

Telecommunication Union (ITU)

Table IV and V show that Uruguay has a relatively cheap connectivity

price compared to the rest of the world. These elements are explained by the

universalization of broadband in the country through the implementation of

optical fiber, which in turn offers greater speed.

|

Mobile broadband prices, prepaid handset-based (500 MB), 2017 |

|

|

Country: |

as % of GNI pc |

|

Uruguay |

0,27 |

|

United States |

0,45 |

|

Canada |

0,49 |

|

Argentina |

0,71 |

|

Costa Rica |

0,84 |

|

Brazil |

1,40 |

|

Source: Measuring the Information Society Report 2018, volume 1 &

2 - International Telecommunication Union |

|

|

|

|

Table IV. Mobile broadband prices in the Americas’ countries, prepaid

handset-based. Source Measuring the

Information Society Report 2018, volume 1 & 2 – ITU

|

Mobile broadband prices, postpaid computer-based (1 GB), 2017 |

|

|

Country: |

as % of GNI pc |

|

Costa Rica |

0,48 |

|

Uruguay |

0,60 |

|

United States |

0,67 |

|

Argentina |

0,83 |

|

Canada |

1,10 |

|

Brazil |

4,82 |

|

Source: Measuring the Information Society Report 2018, volume 1 &

2 - International Telecommunication Union |

|

|

|

|

Table V. Mobile broadband prices in the Americas’ countries, postpaid

computer-based. Source Measuring the

Information Society Report 2018, volume 1 & 2 – International

Telecommunication Union

3.

Infrastructure milestones. - In Uruguay, the main telecommunications operator

is ANTEL (state-owned company). ANTEL has the monopoly over fixed lines for

both voice and Internet, which are mainly delivered through Fiber to the Home

(FTTH). Mobile services, either voice or broadband data are provided by ANTEL,

and the two private and transnational operators Telefónica and Claro; their

market share is 53%, 31% and 16% respectively.

In 1988, the first public packet

switching network was developed with national technology. During the 1990s,

ANTEL began operating cellular telephony and in 1995 the Internet access

service for companies and homes via modem was inaugurated via the copper

telephone line. In 1997 Uruguay became the first country in the Americas and

the sixth in the world to have its entire digitalized telephone network. In

2000, ANTEL began offering Internet access through ADSL broadband services. In

2004, GSM mobile and EDGE services are added for wireless data transmission. In

2005, the Agency for Electronic Government and the Information and Knowledge

Society (AGESIC) was created, whose purpose is to promote the information and

knowledge society through the good use of Information and Communications

Technologies (ICT). In 2010 begins the deployment of the Fiber optic To The Home (FTTH) national project, and in October 2011 the

first home is connected. Since 2011 ANTEL has a national and international

audiovisual signal distribution platform through FTTH and LTE. The transmission

in 4K HDR of the World Cup Russia 2018 through this network stands out as a

world class achievement [8, 9].

In 2014 the connectivity is

improved through the connection to the Monet submarine cable that allows the

direct connection of Uruguay with the United States [8, 9]. More recently,

Uruguay has been distinguished as the first country in Latin America and the

third in the world to offer 5G technology [10].

Uruguay was the first country in

the world to deploy a One Laptop per Child (OLPC) plan nationwide since 2007.

This initiative is called the Plan Ceibal. The ITU

highlights that the implementation of the Plan Ceibal

generated an increase in the number of households that have a computer [7].

However, because the percentage of households with an Internet connection

remained low, some steps were implemented such as: ANTEL begins the

"Universal Homes" project, allowing free access to the Internet and

laying of optical fiber for 300 thousand homes and for all Primary and

secondary schools in locations with more than 10,000 inhabitants. In 2017, the

public Wi-Fi network associated with the Plan Ceibal

was reformulated so that no child had to move more than 300 meters to connect

to the internet. As a result of these policies, the Internet connection gap

between lower-income and higher-income households was significantly reduced.

As of 2015, a similar plan is

implemented, the Plan Ibirapitá, which distributes

one Tablet per senior. Its goal is to promote digital inclusion in the elderly.

The National Agency for Research

and Innovation (ANII) is a government entity that promotes research and

application of new knowledge to the productive and social reality of the

country. It has been a key player by making available funds for research

projects, postgraduate scholarships and incentive programs for

entrepreneurship. [11]

4. Figures of IT industry. - The ICT industry in Uruguay is characterized by great dynamism and

growth, and the country has a focus on technology. The latter is reflected in

infrastructure investments through state-owned ANTEL, in high-quality

university education, and in the export tax benefits of these services. In

relation to the latter, the legal scenario guarantees the exemption in the

payment of Value Added Tax (VAT) for exports of software and computer services,

and the exemption to the payment of Income Tax to the production of software

when certain requirements are met [12].

According to data from the Uruguayan Chamber of Information Technology

(CUTI), the IT sector increased its turnover by 6% in 2018 reaching USD 1,687

million, in relation to the same period of 2017, this being the highest figure

in history. On the other hand, sales to the rest of the world grew by 12.7%.

Sales to the domestic market, where the state-owned company ANTEL has an

important weight, increased 1.3% in the same period. In this sense, it is

evident that companies turn to the external market since they can obtain better

prices for the services provided [13, 29]. In 2016, the turnover of the sector

represented 2.2% of the Gross Domestic Product (GDP) [14], while in 2017 this

ratio amounted to 2.5%[6] [15]. By comparison, the beef manufacturing industry accounted for 1.7%

of GDP and 1.5% respectively[7]. This is outstanding, since agricultural product, and particularly

beef, have traditionally been the main products of Uruguay.

When evaluating the evolution of the sector in relation to the

traditional export items of Uruguay, we can verify its growth and note that, in

2017 and 2018, it exceeded milk exports and those of rice [2, 16]. The main

figures of exports of Uruguay during the last years are depicted in Table VI.

|

|

Exports

of Good & Services in million of USD |

|||

|

|

2015 |

2016 |

2017 |

2018 |

|

Beef |

1.419 |

1.432 |

1.505 |

1.627 |

|

Raw wood |

572 |

591 |

706 |

746 |

|

Soy |

1.122 |

873 |

1.188 |

526 |

|

Milk |

374 |

375 |

384 |

470 |

|

Rice |

360 |

432 |

446 |

398 |

|

Informatic and Telecommunications |

310 |

364 |

465 |

517 |

|

Source: Own elaboration based on data from Uruguay XXI and Central

Bank of Uruguay. |

|

|||

Table VI. Export figures of Uruguay by category, 2015 to 2018. Source own elaboration based on data from

Uruguay XXI and Central Bank of Uruguay

As for the destination, 65.9% of exports are to the United States, and

since 2014 sales to this country have been growing significantly. Although this

data is auspicious given that the North American market is very wide, the

concentration leaves Uruguay vulnerable to regulatory changes in that country.

The second most important destination is the neighbor country Argentina, with a

5.1% share [13].

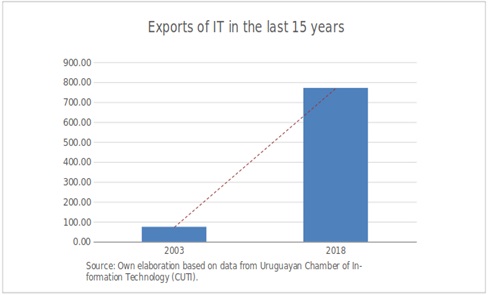

Figure I resume the dramatic growth of exports belonging to IT sector in

the period 2003-2018.

|

On the other hand, in relation to employment, the sector hires

approximately 25,000 people. One of the main obstacles that companies face is

that the number of human resources would not be keeping pace with the growth

rate of the sector. Because of this, several companies are stopping engaging

with some projects because they do not have the professionals to carry them

out. On the other hand, this fact has fostered collaboration between different

companies that have associated between them to carry out large-scale

international projects.

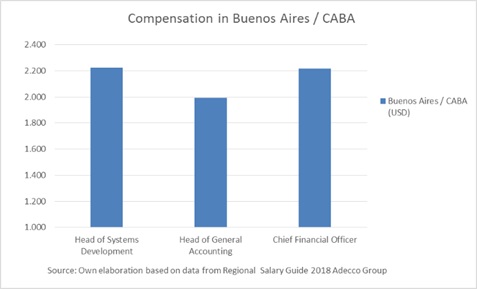

The lack of enough qualified specialists explains that the salary levels

are 30% above average in the country. Employers offer benefits to capture and

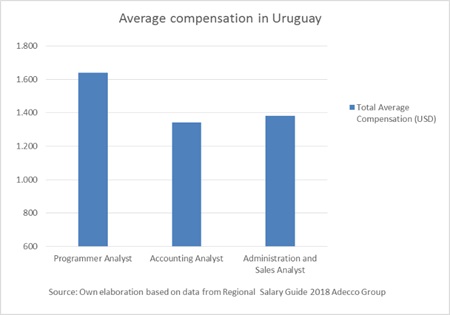

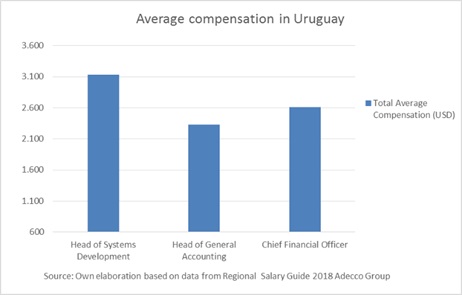

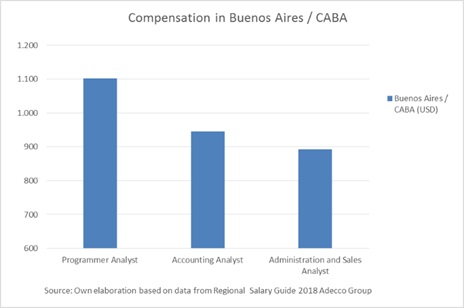

retain talents [13]. Figures II to V present some data from a report by the

consultant company Adecco for 2018 [17]. According to it, in Uruguay and Buenos

Aires - CABA (the capital city of Argentina, the Uruguayan closest neighbor),

the Programming Analysts would be earning, on average, approximately 20% more

than the Accounting Analysts and Administration and Sales Analysts. Meanwhile,

in Uruguay, within the leadership positions, those associated with technology

and telecommunications such as a Systems Development Department have a

remuneration 19% higher than headquarters associated with administration and

finance. However, in Buenos Aires - CABA the latter would not be the case,

given that a Chief Financial Officer would have a remuneration very similar to

a Chief of Systems Development. Besides, positions in the IT sector, either

analyst or head of department are better paid in Uruguay than in Argentina.

|

|

|

|

5. Academia and

Education.-. The beginning of university

careers associated with computer science was very early, compared to other

Latin American countries. In the ‘60s the School of Engineering of Universidad

de la República

began its courses in information technology careers [18]. Today, Uruguay

has one public and four private universities, and two public technological

universities. Research is made at these universities by researchers that are

included in a national registry managed by ANII (National System of

Researchers, SNI). Academics in the field of IT have frequent collaboration at

national and international level. ANII provides competitive funds for research

projects as well as co-founds projects in which academia collaborates with

industry fostering innovation.

There are several offers to train in information technologies, and there

is an increase in the entrance to technical and degree careers [19, 20, 21]. In

2017, incomers to IT courses increased by 4.4% in relation to 2016, at

universities and 9.9% in technical careers. Women preferred degree careers,

while men further increased the entrance into technical careers. As for the

exits, a decrease of 2.1% was observed in the degree courses, while in the

technical courses there was an increase of 27.9%, both with respect to the

previous year. Table VII and VIII show the number of students in 2017 and 2016;

it can be noted that number of women is inferior to that of men.

|

2017 |

|||||||||

|

|

Entry |

Enrolled |

Exit |

||||||

|

|

W |

M |

T |

W |

M |

T |

W |

M |

T |

|

Degree Courses |

303 |

1.261 |

1.564 |

1.010 |

3.105 |

4.115 |

97 |

378 |

475 |

|

Technical Careers |

183 |

746 |

929 |

514 |

2.134 |

2.648 |

78 |

280 |

358 |

Table VII. Number of students enrolling and graduating in IT careers and

total population in 2017, separated by women (W), men (M) and total (T). Source

own elaboration based on data from Statistical yearbook 2017 – Ministry of

Education and Culture

|

2016 |

|||||||||

|

|

Entry |

Enrolled |

Exit |

||||||

|

|

W |

M |

T |

W |

M |

T |

W |

M |

T |

|

Degree Courses |

298 |

1.200 |

1.498 |

966 |

3.289 |

4.255 |

118 |

367 |

485 |

|

Technical Careers |

186 |

659 |

845 |

460 |

1.991 |

2.451 |

49 |

231 |

280 |

Table VIII. Number of students enrolling and graduating in IT careers

and total population in 2016, separated by women (W), men (M) and total (T).

Source own elaboration based on data from Statistical yearbook 2016 – Ministry

of Education and Culture

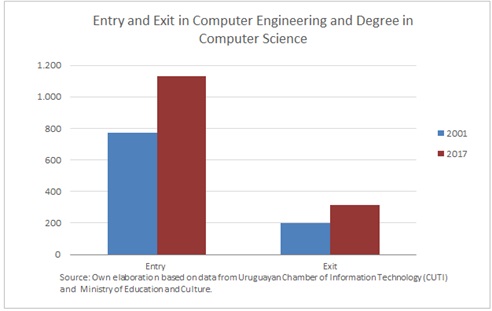

An additional concern is the high desertion in Engineering careers. As

shown in Figure VI, between 2001 and 2017, the number of incoming students to

study in Computer Engineering or Computer Science increased by 360 but the

number of graduates increased only by 115 in 2017.

|

In addition to the careers offered by public and private universities,

there are the following programs:

a) Young people to Program: It started in 2017 and there are already

1,400 graduates of the first two editions. The 2019 edition opened only for

women. The duration of the program is 8 - 9 months. It is present on most of

the country [22].

b) B_IT: It is an online free training program that offers the title of

IT Analyst. It started in 2018. It has a duration of two years. In the 2019

edition 1,000 scholarships were offered [23].

c) Ánima: It started in 2016. It is a proposal

of technological baccalaureate that combines study with work experience. It

offers two orientations: Administration and Information and Communication

Technologies. Students carry out paid internships 12 hours a week in some of

the 21 companies that participate in the project. 62% of first-generation

students who have already graduated were hired by companies in the sector [24].

Another problem that exists is that most of the IT industry and the

general population is concentrated in Montevideo, the capital city. A project

that aims to encourage technology companies to settle in the rest of the

country is the so-called Jacarandá Project. The idea

is to promote work teams in other minor cities to encourage students from other

regions to train in IT so they do not need to travel to Montevideo to work

[25].

Among the main obstacles - which once saved will represent great

opportunities - are: as already mentioned, the low availability of trained

professionals that does not accompany the growth of the sector, the absence of

a financial market that favors risk capital, the high level of local and

international competition given that it is a sector that competes with foreign

companies, and the high turnover of technicians, which is associated with the

limited availability of professionals [13,15].

In recent years, the service sector has been characterized as one of the

most dynamic globally. In particular, services related to technologies are

becoming more important in relation to more traditional services such as

tourism and transport [26, 27], and Uruguay has followed this worldwide

process. In particular, the Uruguayan ICT industry is recognized

internationally and has proven to have an entrepreneurial culture although it

is still a sector that has a lot of potential to develop. In this sense,

business chambers together with government agencies have been working for

several years to reinforce the quality levels of human resources in the sector

and publicize the benefits offered by the country and the potential of the

industry internationally.

There are incentives for international companies to stablish in

Uruguayan free trade zones to provide IT services worldwide. This has led to

success cases in the field of Business Process Outsourcing (BPO), Knowledge

Process Outsourcing (KPO) and Information Technology Outsourcing (ITO).

Governmental Agency Uruguay XXI encourages foreign investment in the area and

facilitates responses to inquiries about potential investments [28].

In Uruguay, access to risk capitals is not usual, this has meant a

limitation for some entrepreneurs.

6. Conclusion. - In this short article, we have reviewed the current state of the IT

industry in Uruguay, the salient features of its numbers and the infrastructure

that makes it possible.

The main elements to highlight are:

- There have been several investments in infrastructure to promote the

sector and helped its development. Governmental agencies encourage investments

in the area and provide information to foreign companies considering locating

in Uruguay.

- There is a growth in the number of professionals in the area, which is

explained by the improvement of the ratio of exit – entry to technology

careers, the increase in enrollment and the “import” of human resources from

abroad. Also worth noting is the

increase of entry of woman to technology careers. All these elements help to

fill the gap that exists between the demand and the labor supply of the sector,

although it is not yet sufficient.

- Services related to technologies are becoming more important in

relation to the more traditional ones. In the last few years, the service

sector has been one of the most dynamic globally and Uruguay was not the

exception. We have seen that in recent years the sector's exports have been

growing at significant rates and have even surpassed other products already

consolidated in the Uruguayan export market.

7. References

[1] Leading Digital Governments. Available: https://leadingdigitalgovs.org Last accessed October 11, 2019

[2] Central Bank of Uruguay. Available: https://www.bcu.gub.uy/Estadisticas-e-Indicadores/Paginas/Balanza-MBP-6.aspx (In Spanish) Last accessed October 11, 2019

[3] National Statistics Institute, Uruguay. Available: http://www.ine.gub.uy/web/guest/estimaciones-y-proyecciones

(In Spanish) Last accessed October 11, 2019

[4] Central Bank of Brazil.

Available:

https://www3.bcb.gov.br/sgspub/localizarseries/localizarSeries.do?method=prepararTelaLocalizarSeries (In Portuguese) Last accessed October 11, 2019

[5] National Institute of Statistics and Censuses, Argentina. Available:

https://www.indec.gob.ar/indec/web/Nivel4-Tema-3-35-45

(In Spanish) Last accessed October 11, 2019

[6] Economic Commission for Latin America and the Caribbean, August

2016. The new digital revolution: from the Internet of consumption to the

Internet of production. Available: https://www.cepal.org/en/publications/38767-new-digital-revolution-consumer-internet-industrial-internet Last accessed October 11, 2019

[7] International Telecommunication Union (ITU), 2018. Measuring the

Information Society Report, volume 1 and volume 2. Available: https://www.itu.int/en/ITU-D/Statistics/Pages/publications/misr2018.aspx Last accessed October 11, 2019

[8] National Telecommunications Administration (ANTEL). Historic Review.

Available: http://www.antel.com.uy/institucional/nuestra-empresa/resena-historica

(In Spanish) Last accessed October 11, 2019

[9] Catholic University of Uruguay, Competitiveness Institute, School of

Business Sciences, 2015. The ICT Industry in Uruguay: Analysis of

Competitiveness and Clustering Possibilities. Available: https://ucu.edu.uy/sites/default/files/facultad/fce/i_competitividad/La_Industria_de_las_TIC_en_Uruguay%202015_InstitutodeCompetitividad_UCU.pdf (In Spanish) Last accessed October 11, 2019

[10] NOKIA website: “ANTEL and Nokia make the first 5G call on a

commercial network in Latin America”. Available: https://www.nokia.com/about-us/news/releases/2019/04/10/antel-and-nokia-make-the-first-5g-call-on-a-commercial-network-in-latin-america/ Last accessed October 11, 2019

[11] National Agency for Research

and Innovation (ANII). Available: https://www.anii.org.uy/institucional/acerca-de-anii/#/acerca-de-anii (In Spanish) Last accessed October 11, 2019

[12] DCA Professional Services, 28 February 2019. Tax modifications for

the Software activity in Uruguay. Available: https://www.dca.com.uy/wp-content/uploads/2019/02/Modificaciones-impositivas-para-la-actividad-de-Software-en-Uruguay.pdf (In Spanish) Last accessed October 11, 2019

[13] Radio Broadcasting ‘En Perspectiva’, 27

September 2018. Interview to the President of CUTI. Available: https://www.enperspectiva.net/home/ano-record-las-tecnologias-la-informacion-facturacion-del-sector-aumento-26-2017-crecimiento-extraordinario-segun-leonardo-loureiro-cuti/ (In Spanish) Last accessed October 11, 2019

[14] Uruguayan Chamber of Information Technology (CUTI). Revenue from

the ICT sector accounted for 2.2% of GDP in 2016 and exports grew 10%. Available:

https://www.cuti.org.uy/novedades/662-ingresos-del-sector-de-las-tic-represento-2-2-del-pib-en-2016-y-exportaciones-crecieron-10

(In Spanish) Last accessed October 11, 2019

[15] Radio Broadcasting ‘FM del Sol’, 17 July 2019. Interview to the

President of CUTI. Available: https://delsol.uy/facildesviarse/entrevista/de-quien-es-el-exito-de-la-industria-del-software-uruguayo (In Spanish) Last accessed October 11, 2019

[16] Uruguay XXI. Exports by items 2001-2018. Available: https://www.uruguayxxi.gub.uy/es/centro-informacion/articulo/exportaciones-por-partidas/

(In Spanish) Last accessed October 11, 2019

[17] The Adecco Group, 2018. Regional Salary Guide Argentina – Uruguay

2018.

[18] Uruguay XXI, August 2014. The ICT industry in Uruguay. https://www.smarttalent.uy/innovaportal/file/862/1/la_industria_tic_en_uruguay.pdf

(In Spanish) Last accessed October 11, 2019

[19] Ministry of Education and Culture. Statistic yearbook 2017.

https://www.mec.gub.uy/mecweb/mec2017/container.jsp?contentid=927&site=5&channel=mec&3colid=927

(In Spanish) Last accessed October 11, 2019

[20] Ministry of Education and Culture. Statistic yearbook 2016. Available:

https://www.mec.gub.uy/mecweb/mec2017/container.jsp?contentid=927&site=5&channel=mec&3colid=927

(In Spanish) Last accessed October 11, 2019

[21] Uruguayan Chamber of Information Technology (CUTI), May 2018.

Academic Training in ICT, Report 2017. Available: https://www.cuti.org.uy/public/documentoscuti/Informe%202017%20Formacion%20Academica%20en%20TIC_Cuti.pdf (In Spanish) Last accessed October 11, 2019

[22] Youth to Program. https://jovenesaprogramar.edu.uy/ (In Spanish) Last accessed October 11, 2019

[23] B_IT Program. http://bit.cuti.org.uy/

(In Spanish) Last accessed October 11, 2019

[24] Ánima. Available: https://anima.edu.uy/nuestra-propuesta/ (In Spanish) Last accessed October 11, 2019

[25] Jacarandá Proyect.

Available: https://www.presidencia.gub.uy/comunicacion/comunicacionnoticias/industria-tecnologia-cuti-loureiro-cosse-descentralizacion-interior (In Spanish) Last accessed October 11, 2019

[26] United Nations Conference on Trade and

Development (UNCTAD), 28 May 2019. International Trade in Services 2018.

Available: https://unctad.org/en/PublicationsLibrary/gdsdsimisc2019d9_en.pdf Last accessed October 11, 2019

[27] Uruguay XXI, February 2017. Global Export Services in Uruguay. Available:

https://www.uruguayxxi.gub.uy/uploads/informacion/Global-Export-Services-Uruguay-XXI-February-2017-7.pdf Last accessed October 11, 2019

[28] National Agency Uruguay XXI.

Available: https://www.uruguayxxi.gub.uy/en/invest/sectors/global-services-2/it-industry/ Last accessed October 11, 2019

[29] El Pais Newspaper. Available: https://www.elpais.com.uy/negocios/noticias/sector-tecnologia-alcanzo-facturacion-record-aspira-peso-mayor-pib.html Last accessed September 12, 2021